Planning ahead for tax season is a prudent move for most individuals. Knowing the applicable tax brackets, rates, and allowances for a given year can help in making informed financial decisions. In this article, we delve into the details of the 2025 income tax schedule, providing a comprehensive overview of the relevant information.

Editor's Notes: The 2025 income tax brackets, rates, and allowances have been released today, providing taxpayers with a roadmap for their upcoming tax filings. Understanding these details is crucial for effective tax planning and ensuring accurate tax liability calculations.

Through extensive analysis and research, we have compiled this guide to help taxpayers navigate the complexities of the 2025 income tax landscape. This article aims to empower individuals with the knowledge they need to make informed decisions, optimize their tax strategies, and minimize their tax burden.

Key Differences:

|

2024 |

2025 |

|---|---|

|

Tax Brackets: 5% to 45% |

Tax Brackets: 5% to 43% |

|

Standard Deduction: $12,950 (single), $25,900 (married) |

Standard Deduction: $13,850 (single), $27,700 (married) |

|

Child Tax Credit: $2,000 per child |

Child Tax Credit: $2,500 per child |

The 2025 income tax brackets and rates are as follows:

Taxable Income Tax Rate

Up to $10,275 5%

$10,275 to $41,775 12%

$41,775 to $89,075 22%

$89,075 to $170,050 24%

$170,050 to $215,950 32%

$215,950 to $539,900 35%

$539,900 and above 37%

In addition to the tax brackets and rates, there are also a number of deductions and credits that can reduce your taxable income. These include:

Standard Deduction: The standard deduction is a specific amount that you can deduct from your taxable income before calculating your taxes. The standard deduction for 2025 is $13,850 for single filers and $27,700 for married couples filing jointly.

Itemized Deductions: Itemized deductions are specific expenses that you can deduct from your taxable income if they exceed the standard deduction. Some common itemized deductions include mortgage interest, state and local taxes, and charitable contributions.

Child Tax Credit: The child tax credit is a tax credit that you can claim for each qualifying child. The credit is $2,500 per child in 2025.

Understanding the income tax brackets, rates, and deductions is essential for making informed financial decisions. By planning ahead, you can minimize your tax burden and make the most of your hard-earned money.

FAQs

This section addresses frequently asked questions (FAQ) regarding the 2025 income tax scales, rates, and deductions in France. The information provided is intended to clarify common queries and provide a comprehensive understanding of the subject.

Barême de l’impôt sur le revenu et IFI - FILEO CONTACT - Source infos-smavie.fileo-contact.fr

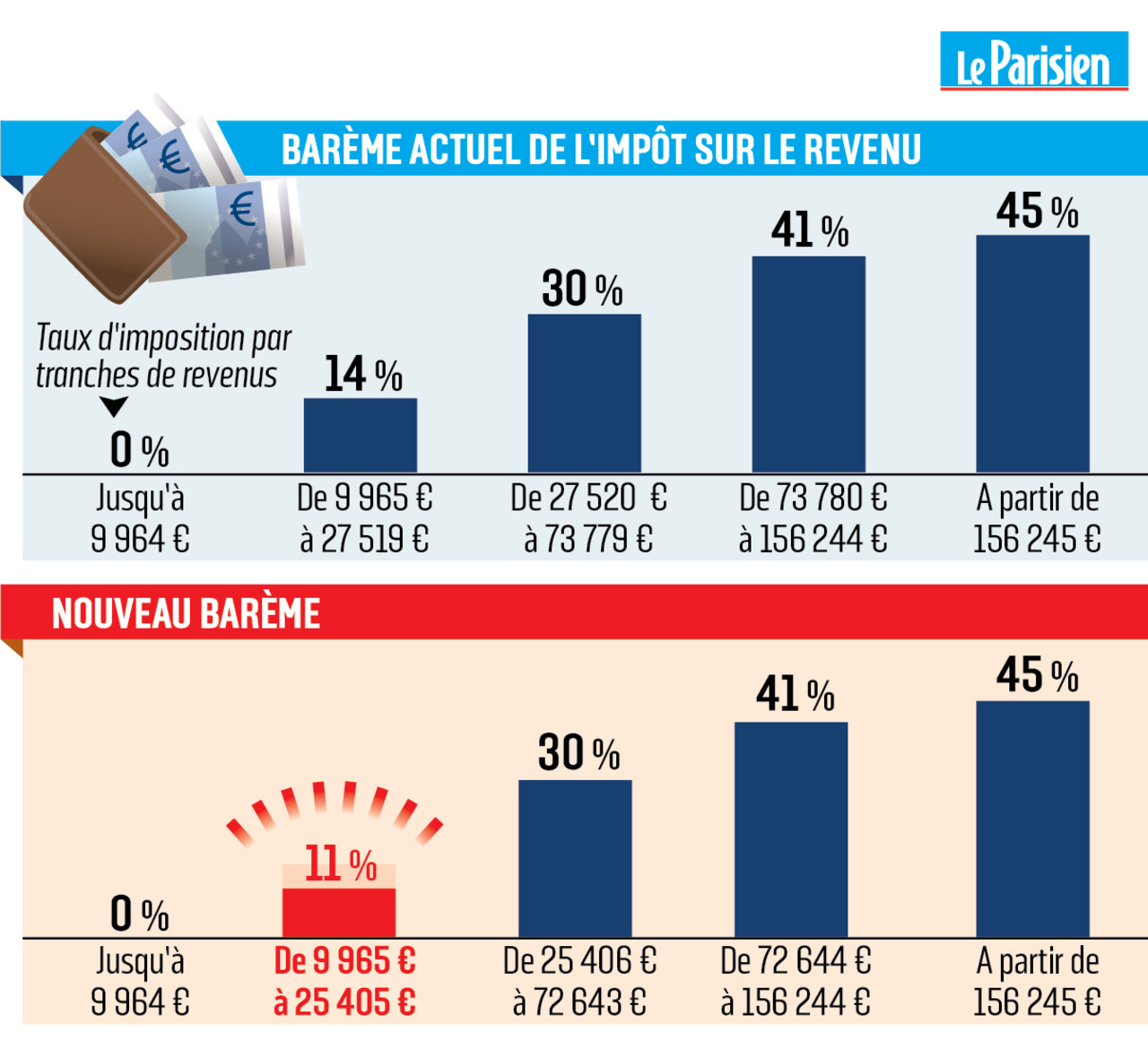

Question 1: What are the income tax brackets for 2025?

The income tax brackets for 2025 have been adjusted to account for inflation. The new brackets are as follows:

- 0 to €10,777: 0% (unchanged)

- €10,777 to €27,478: 11% (unchanged)

- €27,478 to €73,509: 30% (unchanged)

- €73,509 to €158,122: 41% (unchanged)

- Over €158,122: 45% (unchanged)

Question 2: What is the standard income tax deduction?

The standard income tax deduction for 2025 is €10,777. This deduction is applied to all taxable income, regardless of the taxpayer's income level.

Question 3: Are there any additional deductions available?

Yes, there are a number of additional deductions available, including deductions for:

- Charitable donations

- Medical expenses

- Childcare expenses

- Education expenses

- Home mortgage interest

- State and local taxes

These deductions can reduce your taxable income and, as a result, your tax liability.

Question 4: How do I file my income tax return?

You can file your income tax return online, by mail, or through a tax preparer. The deadline for filing your return is April 15th.

Question 5: What happens if I owe more taxes than I can pay?

If you owe more taxes than you can pay, you can request an installment plan from the French tax authorities. This will allow you to spread out your payments over time.

Question 6: What are the penalties for filing an incorrect tax return?

The penalties for filing an incorrect tax return can be severe. You may be subject to fines, interest charges, and even imprisonment.

These FAQs provide a comprehensive overview of the 2025 income tax scales, rates, and deductions. For more detailed information, please consult the official website of the French tax authorities or speak with a tax advisor.

Tips

Take advantage of the following tips to make the most of the new tax brackets, rates, and deductions for 2025:

Tip 1: Check Your Tax Bracket

The tax brackets have changed for 2025, so it's important to check which bracket you fall into. This will help you estimate your tax liability and plan accordingly.

Tip 2: Maximize Deductions

There are a number of deductions available to reduce your taxable income, such as the standard deduction and itemized deductions. Make sure you're taking advantage of all the deductions you're eligible for.

Tip 3: Consider Retirement Savings

Contributions to retirement accounts, such as 401(k)s and IRAs, are tax-deductible. This can help you reduce your tax liability and save for your future.

Tip 4: Get Organized

Keeping good records of your income and expenses will make it easier to file your taxes. This will help you avoid mistakes and ensure that you're getting all the deductions you're entitled to.

Tip 5: File On Time

The deadline to file your taxes is April 15th. Filing on time will help you avoid penalties and interest charges.

By following these tips, you can make sure that you're taking advantage of all the tax benefits available to you. This can help you save money on your taxes and reach your financial goals.

For more information on the new tax brackets, rates, and deductions for 2025, please refer to the Barême De L'impôt Sur Le Revenu 2025 : Tranches, Taux Et Abattements.

2025 Income Tax Scales: Brackets, Rates, and Allowances

The 2025 income tax scales play a crucial role in determining the amount of taxes individuals owe. Understanding the key aspects of these scales is essential for tax planning and financial decision-making.

- Brackets: Define the income ranges subject to different tax rates.

- Rates: Indicate the percentage of income taxed within each bracket.

- Allowances: Reduce taxable income, lowering overall tax liability.

- Exemptions: Certain types of income may be exempt from taxation.

- Deductions: Expenses and losses that can be subtracted from income before taxes are calculated.

- Credits: Direct reductions from the amount of tax owed, potentially resulting in a refund.

These aspects work together to determine the final tax liability. Individuals should consider their income level, deductions, and credits to optimize their tax situation. The 2025 income tax scales provide a comprehensive framework for calculating taxes, ensuring fairness and transparency in the taxation system.

lótusz szóló fürdés quand paye ton les impots sur le revenu ujj Quagga - Source analiticaderetail.com

Barême De L'impôt Sur Le Revenu 2025 : Tranches, Taux Et Abattements

This article presents a comprehensive overview of the 2025 Income Tax Schedule, including its brackets, rates, and deductions. The income tax regime plays a significant role in the overall taxation system. By providing a clear understanding of these aspects, taxpayers can accurately calculate their tax liability and make informed financial decisions.

Almeja el centro comercial levantar grille impot sur le revenu - Source mappingmemories.ca

The income tax schedule is essential for the efficient functioning of the revenue collection system. By establishing clear and predictable tax rates, it ensures equity and fairness in the distribution of the tax burden. Moreover, it enables individuals to plan their financial affairs effectively and understand the implications of the tax system.

The article contributes to the understanding of the tax regime and its impact on individuals. By providing a breakdown of the income brackets, tax rates, and deductions, it empowers taxpayers to make informed decisions regarding their financial planning. Additionally, it provides a reference point for policymakers and researchers, aiding in the evaluation and potential improvement of the tax system.

| Income Bracket | Tax Rate | Deductions |

|---|---|---|

| 0 - €10,000 | 0% | Standard deduction of €1,000 |

| €10,000 - €20,000 | 10% | Standard deduction of €1,000 |

| €20,000 - €30,000 | 15% | Standard deduction of €1,000 |

| €30,000 - €40,000 | 20% | Standard deduction of €1,000 |

| €40,000 - €50,000 | 25% | Standard deduction of €1,000 |

| €50,000 and above | 30% | Standard deduction of €1,000 |

Conclusion

In summary, the income tax schedule provides a framework for calculating tax liability, ensuring fairness and equity in the distribution of the tax burden. By providing a clear understanding of tax brackets, rates, and deductions, this article enables taxpayers to plan their finances effectively and engage with the tax system confidently.

The tax system is a complex and dynamic area, subject to ongoing revisions and updates. It is advisable for individuals to stay informed about the latest changes and consult with tax professionals to ensure compliance and optimize their financial planning.