Interest Rate Update: Key Takeaways And Implications For Borrowers And Investors

Editor's Notes: Interest Rate Update: Key Takeaways And Implications For Borrowers And Investors have published today date. As you know, Interest Rate Update: Key Takeaways And Implications For Borrowers And Investors is vital to every individual who has financial responsibility, ranging home and car owners to your everyday consumer.

In this article, we analyze Interest Rate Update: Key Takeaways And Implications For Borrowers And Investors, dig into the data, and offer insights to help you make informed decisions.

FAQ

This comprehensive FAQ section addresses common questions and concerns regarding the recent interest rate update and its implications for borrowers and investors.

Question 1: What are the key takeaways from the interest rate update?

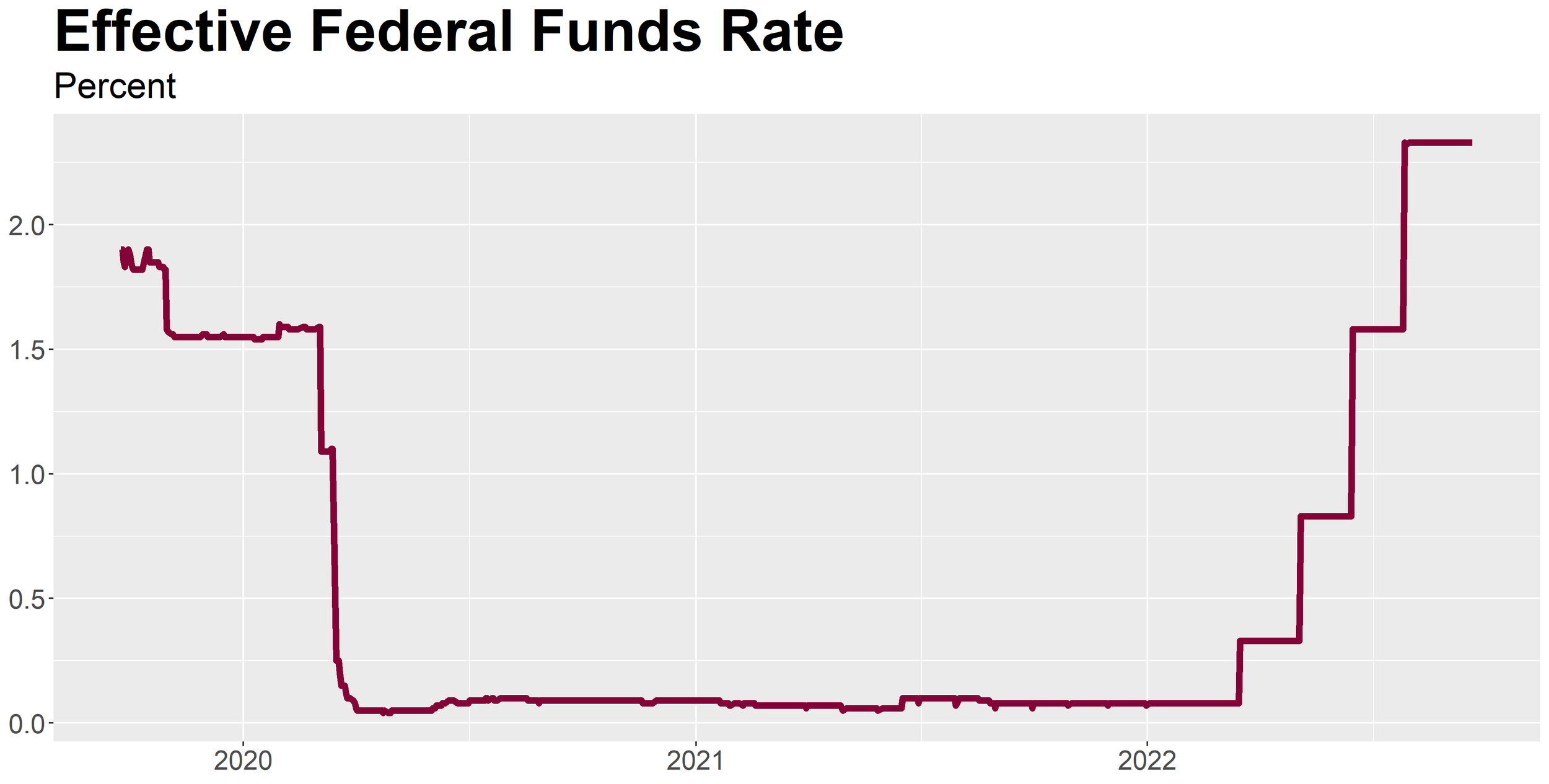

The update signifies the Federal Reserve's continued commitment to controlling inflation, emphasizing that rate hikes may persist until inflation falls within the target range. Borrowers can expect higher interest rates on loans and mortgages, while investors may benefit from higher returns on fixed income investments.

PAMGMT | Three Takeaways from the September Fed Meeting - Source www.pamgmt.com

Question 2: How will the rate increase affect borrowers?

Borrowers with adjustable-rate loans and mortgages will face higher monthly payments due to the interest rate increase. Those considering taking out new loans should be prepared for higher interest costs and may want to explore options with fixed rates to mitigate the impact.

Question 3: What are the implications for investors?

Investors may benefit from the interest rate update as higher rates lead to increased yields on fixed income investments such as bonds and CDs. However, higher interest rates can also lead to price declines in growth stocks and other high-risk assets.

Question 4: What should borrowers do in response to the rate increase?

Borrowers with adjustable-rate loans may want to consider refinancing into fixed-rate loans to lock in lower interest rates. Additionally, borrowers should review their budgets to accommodate higher loan payments and explore options to reduce expenses.

Question 5: How can investors navigate the interest rate environment?

Investors can adjust their portfolios by increasing the allocation to fixed income investments, focusing on short-term bonds with lower interest rate risk. Additionally, they can consider diversifying into alternative asset classes such as real estate or commodities to mitigate market volatility.

Question 6: What should be considered when making financial decisions in this environment?

Both borrowers and investors should consult with financial professionals to assess their individual situations and make informed decisions. It is crucial to understand the risks and potential impacts of the interest rate update on financial goals and make adjustments accordingly.

Overall, it is essential to monitor the evolving interest rate environment and make prudent financial decisions to mitigate risks and optimize returns.

Transition to the next article section: For a comprehensive analysis of the implications of the interest rate update, please refer to the related article "Interest Rate Update: A Deep Dive into the Impact on Borrowers and Investors."

Tips

Stay informed about interest rate changes to make informed financial decisions. Here are some key takeaways and implications to consider:

Tip 1: Monitor interest rate trends

Keep track of central bank announcements, economic data, and market forecasts that influence interest rate movements. Interest Rate Update: Key Takeaways And Implications For Borrowers And Investors Understanding the factors driving interest rate changes helps anticipate future adjustments.

Tip 2: Adjust borrowing strategies

If interest rates are rising, consider locking in lower rates on adjustable-rate loans or refinancing existing debts to avoid higher monthly payments. Conversely, if rates are falling, explore opportunities for refinancing or taking out new loans at lower interest costs.

Tip 3: Reassess investment portfolios

Interest rate changes can impact asset prices, particularly fixed-income investments. Rising rates typically lead to lower bond prices, while falling rates boost their value. Adjust investment portfolios accordingly to manage risk and maximize returns.

Tip 4: Plan for potential market volatility

Interest rate fluctuations can induce market volatility, affecting stock prices and other asset classes. Build a diversified portfolio and maintain a long-term investment horizon to weather market fluctuations.

Tip 5: Consult financial professionals

Seek guidance from financial advisors or mortgage lenders to navigate interest rate changes and optimize financial strategies. Personalized advice tailored to individual circumstances can enhance decision-making.

Summary

Understanding interest rate changes empowers individuals to make informed financial decisions. By monitoring trends, adjusting borrowing and investing strategies, and seeking professional guidance, one can navigate interest rate fluctuations effectively to achieve financial goals.

Interest Rate Update: Key Takeaways And Implications For Borrowers And Investors

In light of recent interest rate changes, it is crucial for both borrowers and investors to grasp the implications. These key takeaways shed light on the multifaceted impact of interest rate updates.

- Higher Borrowing Costs: Interest rate hikes increase borrowing costs, potentially straining budgets.

- Reduced Borrowing Appetite: Higher rates may dampen borrowing demand, affecting sectors such as housing.

- Lower Investment Returns: Bond prices typically fall when rates rise, leading to potential losses for investors.

- Shifts in Asset Allocation: Investors may adjust their portfolios, allocating more to cash or short-term bonds due to rate uncertainty.

- Economic Growth Implications: Higher rates can slow economic growth by reducing business and consumer spending.

- Inflation Expectations: Interest rate updates can influence expectations about inflation, impacting long-term investment decisions.

key takeaways clipart 20 free Cliparts | Download images on Clipground 2024 - Source clipground.com

These aspects highlight the wide-ranging impact of interest rate updates. Borrowers should carefully consider the increased borrowing costs, while investors may need to re-evaluate their portfolios and investment strategies. The interconnected nature of these factors underscores the importance of staying informed and adapting to changes in the interest rate landscape.

Interest Rate Update: Key Takeaways And Implications For Borrowers And Investors

The recent interest rate update has significant implications for both borrowers and investors. Understanding the connection between interest rates and financial decisions is crucial for navigating the current economic landscape.

3 Key Takeaways Three Key Areas for Investors in Private Equity Funds - Source ktslaw.com

For borrowers, higher interest rates mean increased costs for borrowing money. Mortgages, car loans, and other forms of debt will become more expensive, potentially impacting household budgets and purchasing power. Investors, on the other hand, may benefit from higher interest rates, as they can earn more on savings accounts, bonds, and other fixed-income investments.

The implications of interest rate changes extend beyond individuals to businesses and the economy as a whole. Higher interest rates can slow economic growth by discouraging borrowing and investment, while lower interest rates can stimulate growth by making it cheaper for businesses to expand and consumers to spend.

Staying informed about interest rate updates and their potential impact is essential for making sound financial decisions. Borrowers should consider how higher interest rates may affect their loan payments and explore options for refinancing or debt consolidation. Investors should assess the risk-return profile of their portfolios and consider adjusting their asset allocation accordingly.

| Impact on Borrowers | Impact on Investors |

|---|---|

| Increased borrowing costs | Increased earnings on savings and investments |

| Reduced purchasing power | Greater return on capital |

| Potential slow down in economic growth | Increased risk-return balance in portfolios |